Life Insurance in and around Jacksonville

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

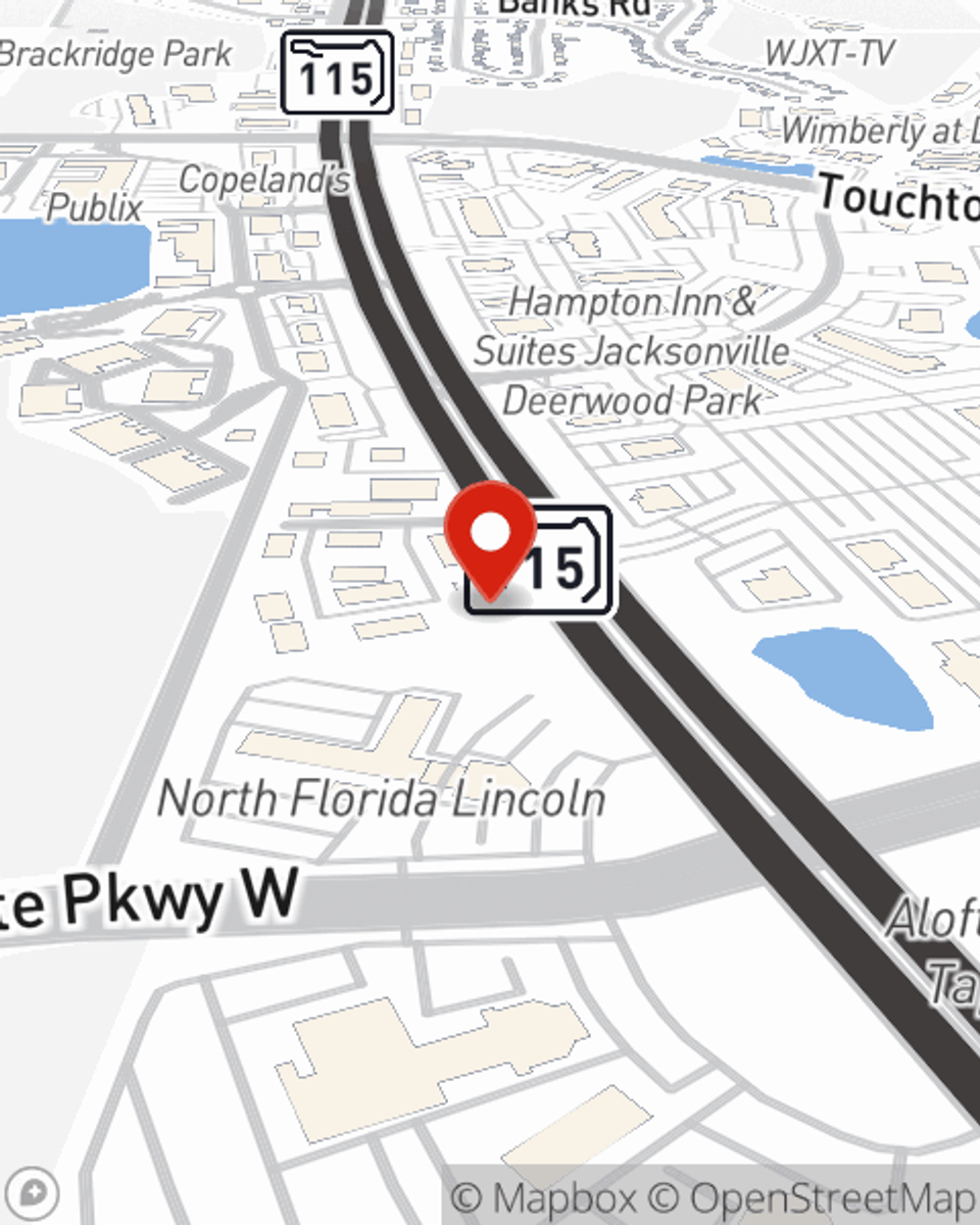

- Jacksonville

- Arlington

- Jacksonville Beaches

- Southside

- Deerwood

- Deercreek

- Nocatee

- Saint John's County

- Mandarin

- San Pablo

- Grove Park

- Jacksonville Golf CC

- J. Turner Butler

- Duval County

- Ponte Vedra

- Fort Caroline

- Nassau County

- Baker County

- Clay County

- Atlantic Beach

- Neptune Beach

- Town Center

Check Out Life Insurance Options With State Farm

It can be what keeps you going every day to provide for your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your loved ones can pay for college and/or keep paying for your home as they face the grief and pain of your loss.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Their Future Is Safe With State Farm

Some of your options with State Farm include coverage for a specific number of years or coverage for a specific time frame. But these options aren't the only reason to choose State Farm. Agent Margie Williams's wonderful customer service is what makes Margie Williams a great asset in helping you settle upon the right policy.

Interested in experiencing what State Farm can do for you? Contact agent Margie Williams today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Margie at (904) 296-2500 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Margie Williams

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.